So you’ve been testing, trialling, making and selling your beer for years, sometimes decades.

With countless hours in loud, cold rooms surrounded by steel vats, sometimes you might wonder “what’s it’s all for?”

This article is intended to help you think about the pro’s and con’s of selling your Craft Brewery or Distillery for the right price.

The benefits are obvious.

Being acquired by a major brewing group affords you a level of security, access to infrastructure, funding to scale production and potentially expose you to a larger customer base. But let’s face it; the main benefit is a reward for all your hard work over the past 5-10 and a big fat cheque.

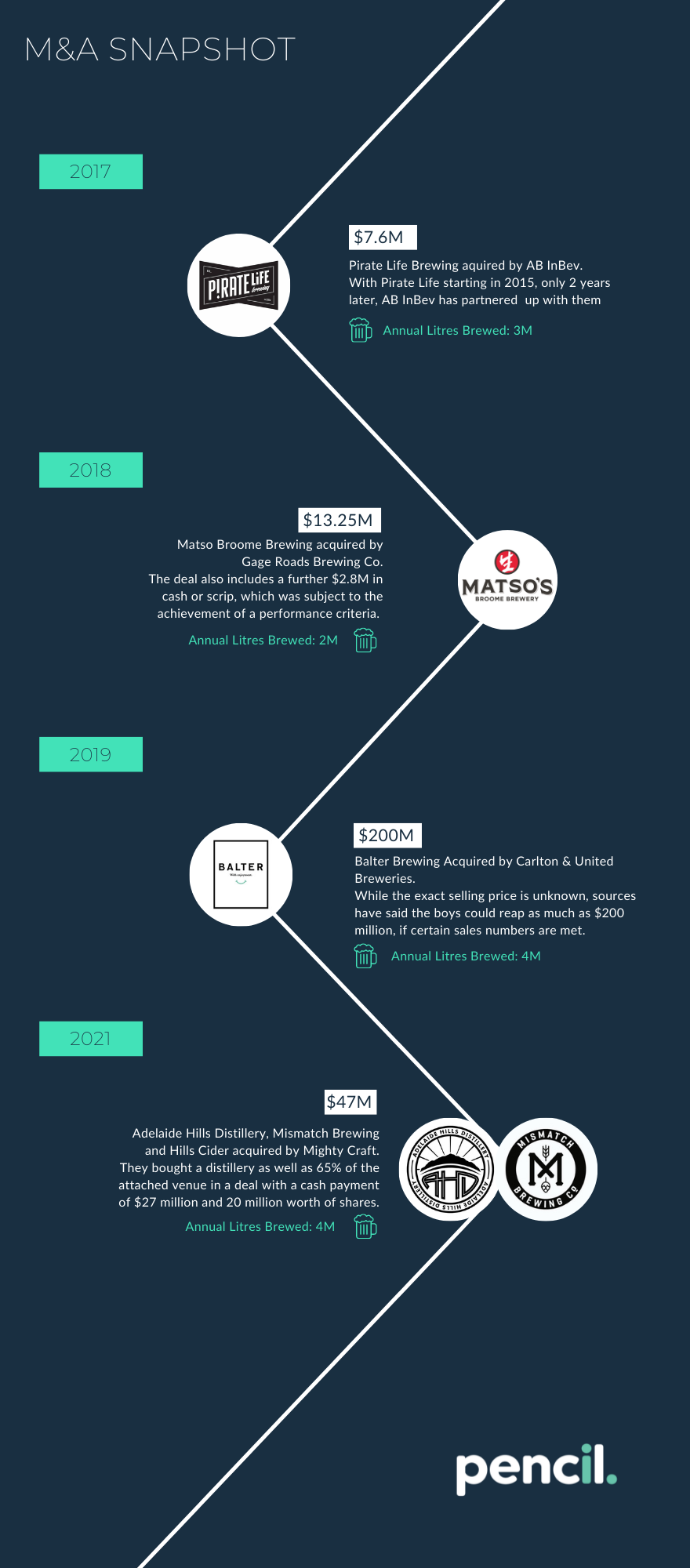

Off the back of a some recent acquisitions in Adelaide by Brewery & Distillery Group; Mighty Craft, we created a short timeline that shows the key metrics of 4 brewery sales over the last 4 years. Treat this as a guide to get a ballpark value of your operation.

Either way, there is an ever growing acquisition path for hungry founders and thirsty investors.

The Key Take-outs

You will see that the amount of litres brewed, doesn’t necessarily correlate with a breweries sale price. So what are the important elements when crafting your sale:

Infrastructure including land, venue fit-out, plant equipment will impact the sale and big loans or older plant equipment will clearly have a negative impact on the sale price.

A recognisable brand with quantifiable brand recognition is very important when discussing multiples. Well known brands and viral marketing will not only open the doors for the initial conversations with brewery groups, but are also valuable before you start brewing.

Production margins need to be above 65% to be an attractive asset.

Building out range is very important. Investors will look to fill gaps either from a pricing, product or geographical perspective. Beer groups known for cheaper lager from Victoria, may want a Western Australian IPA with a higher price point to differentiate. This also may act as a catalyst to elevate the rest of their range by association.

Mighty Craft CEO; Mark Haysmen commented after the recent acquisition of Mismatch Brewing and Adelaide Hills Distillery that “Their beer product, Mismatch, is fabulous and has a great position in the market and Hills Cider is very well regarded in SA and beyond, and 78 Degrees is a great range of brands.”

Things to know

You will need to stay on

You may have heard the term “Golden Handcuffs” before. It simply means that as part of the deal the core team would need to stay on for a period of time. (usually 2-3 years)

Pirate Life co-founder and chief brewer Jared Proudfoot said the whole team will stay on and that the sale will help provide “new facilities and expertise”.

“We have a lot to offer each other and our joint growth plans will commence immediately with a $10 million investment in an exciting new South Australian brewery…”

This sounds good in theory, however anyone familiar with the process will know that going from owning a small or medium business to working for a major has its pro’s and con’s.

Owing an SMB brings a level of freedom with one or two people making all the decisions. You have the ability to move fast and innovate.

Falling into Line

Being consumed by a major player will change all of that. Our sources tell us that getting swallowed up by AB InBev or Asahi will see you lose control of the beer you make and how you sell it. You’ll be lost in a sea of reporting and “internal” meetings, but it’s not all bad, considering the comfort you get from the cheque.

Groups like GoodDrinks (Gage Rd) and Mighty Craft are starting a new movement of “Brewery micro-groups” along with Tribe, Fermentum and VOK. (Image Below) If you are a successful craft brewery these are the radars that you want to get on.

Just like any business, if you’re tracking towards an exit, make sure potential acquirers know you exist and know your numbers. It doesn’t hurt to send monthly 1-page reports by way of update. For more info on breweries, click here.

Happy Brewing.